A double whammy of storms hit Japan and South Korea recently: Typhoons Maysak and Haishen made landfall within a day of each other.

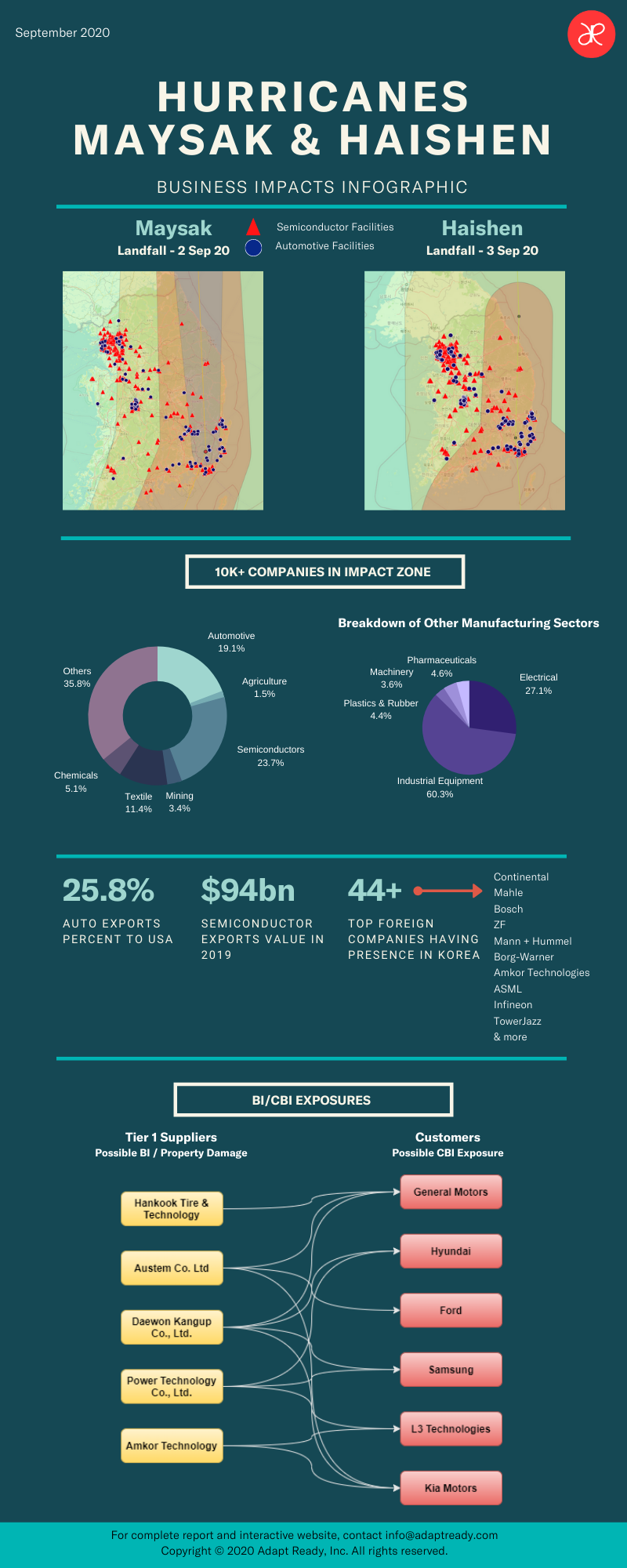

As a result of these storms, South Korea faced a threat to its $110bn+ of semiconductor and automotive export industries according to the latest real-time information gathered by Adapt Ready’s Risk Intelligence Platform. Our initial newsletter tracked Haishen as making landfall as a Category 4-equivalent hurricane and the infographic was prepared with those paths; by the time it reached South Korea, it had been downgraded to Category 2 so the impacts to the identified companies may not be as severe. Nevertheless, the infographic also highlights the accumulation of risk among these industries.

The two main impacted industries are the $23.1bn Automotive parts exports and the more concerning $94bn semiconductor exports industry which currently ranks as South Korea’s largest export industry. Despite the updated path of Typhoon Haishen, they have impacted operational capacity on some of South Korea’s major corporations; and as per our analysis, the companies most exposed to losses right now are Samsung, Amkor, Hyundai, Ford and General Motors, by virtue of their heavy supply chain reliance on South Korea

In the attached infographic you can clearly see how Maysak’s path ran right through the heart of the semiconductor and auto industries in South Korea. Most insurers are able to know the property damage to direct sites of their customers but the impact on lines such as business interruption within the manufacturing sector is impossible to capture without the right tools to assess interconnected risks. They are unable to know or even estimate their BI/CBI exposure, which is paramount during these times. Some of the interesting insights from our risk intelligence platform include:

- 472 semiconductor companies and 426 automotive final assembly/parts supplier companies were in Maysak’s high impact zone (min wind speeds ~90 Km/h and max wind speeds ~176 Km/h)

- The same numbers increased to 653 semiconductor and 528 automotive companies when the focus is on high impact zones of cyclone Haishen.

- Multiple common tier-1 suppliers were in the impact zones of both the cyclones, potentially leading to supply chain issues to bigger companies like Estra Automotive, General Motors, Hyundai, Samsung and Ford.

- There could be a “double edged” impact to supply chains of raw materials and finished goods, both in automotive and semiconductor industries, causing large exposures.

If you would like more details as to impacts to your specific portfolio in that area or just want to be kept up to date with the real-time impact of the cyclones then please reach out using the details below.