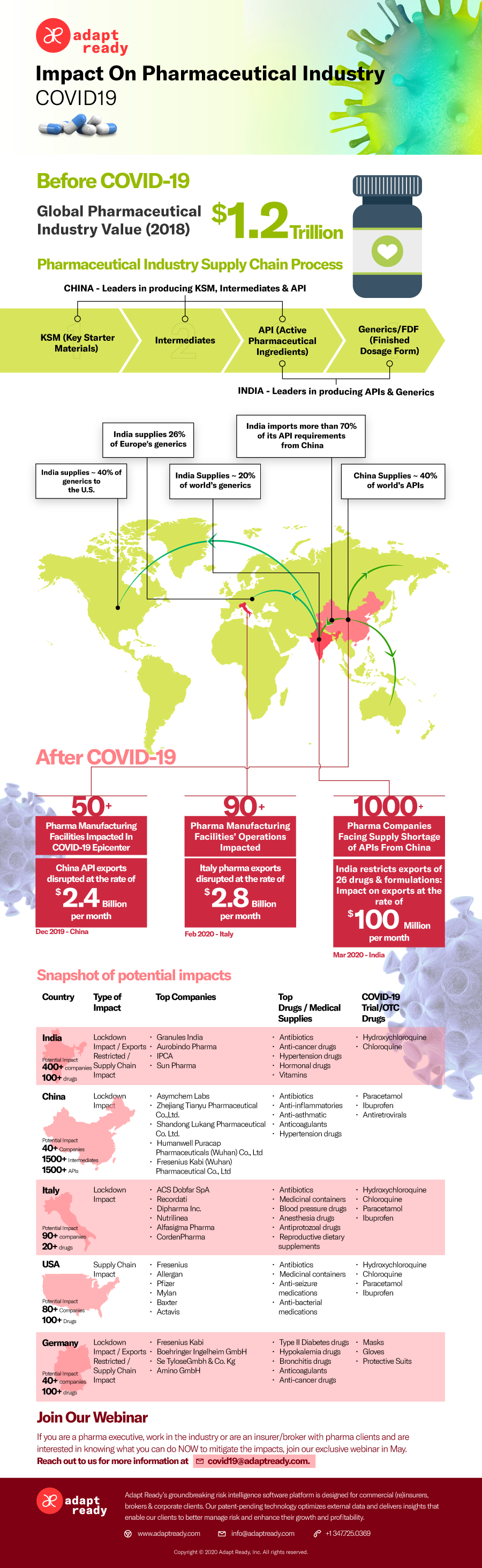

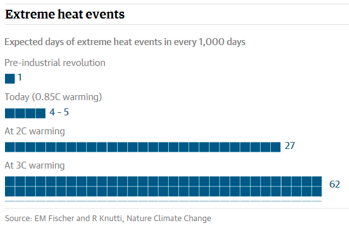

Coronavirus COVID-19 is on everyone’s mind. Here’s a sliver of the global impact it can cause, from the shut down of several operations in China, Hubei in particular

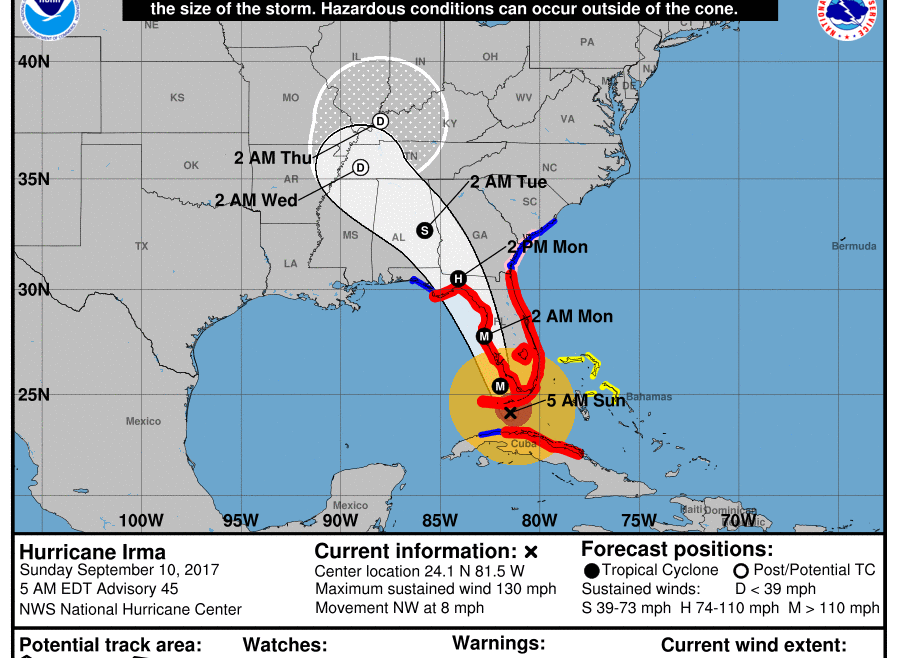

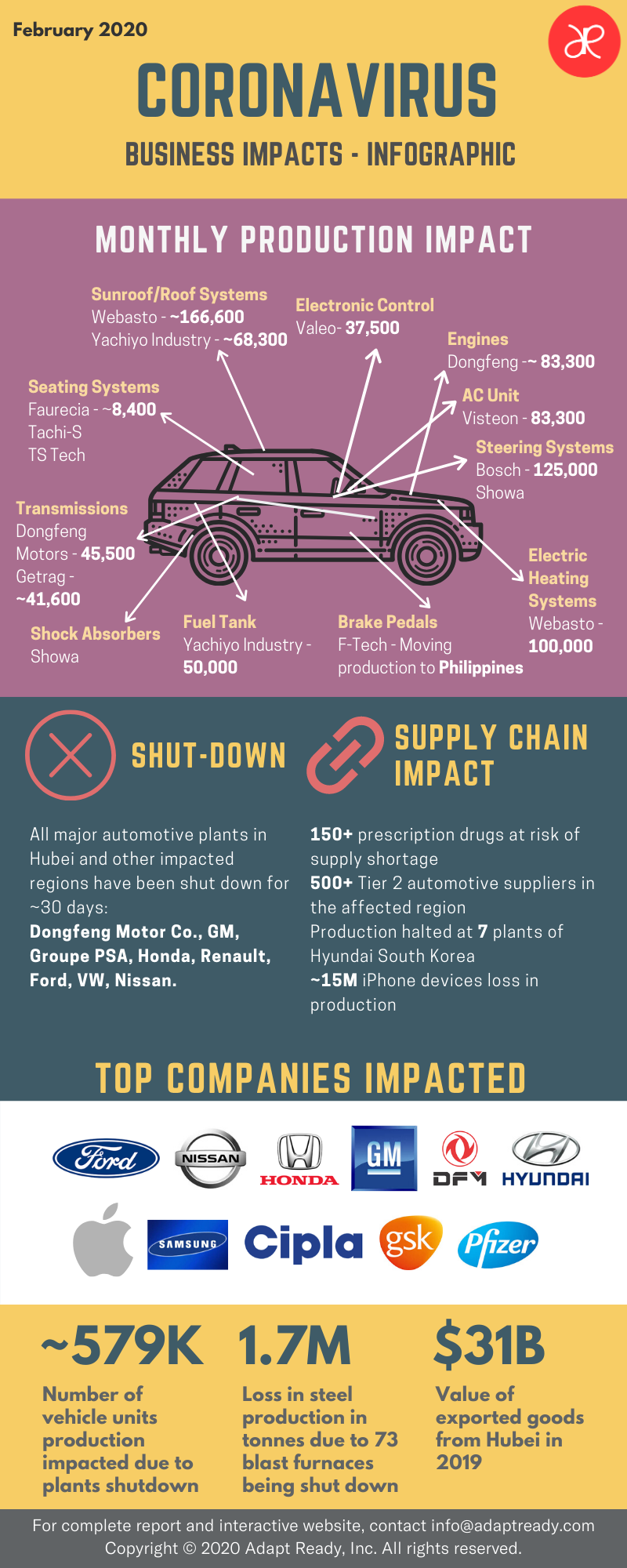

As Hurricane Irma barrels down on Florida, insurers are vulnerable to a myriad of exposures. As of this writing, all the major and minor ports serving the state have been shutdown.

As Hurricane Irma barrels down on Florida, insurers are vulnerable to a myriad of exposures. As of this writing, all the major and minor ports serving the state have been shutdown.

The Tampa, FL port is a crucial gateway for fertilizers as it handles over 20% of the US exports, with its biggest customer, The Mosaic Company, being affected in particular – not just from the port closure, but due to the closure and potential impact on its phosphate production locations in the vicinity.

Mosaic serves customers in over 40 countries, and acknowledges that it conducts operations through a limited number of key production and distribution facilities. (Phosphates accounted for nearly 41% of the company’s revenues in 2016). The larger implications on agri-based businesses (including Campbell Soup, Kellogg, Tyson Foods and PepsiCo) remains to be seen.

Irma is also after orange juice: Bradenton, FL based Tropicana, is the world’s largest producer of branded juice, and one of the billion-dollar-plus subsidiaries of PepsiCo. The Tropicana plant is in the path of the hurricane, and its closure could severely impact production for days to come.

A quick rundown of industrial exposures at major ports follows:

| Major Port | Industry | Potentially Impacted Companies |

| Tampa | Fertilizer, Agriculture, Food & Beverage | Mosaic Company; PepsiCo; Campbell Soup |

| Jacksonville | Auto industry (635,000 automobiles imported annually) | Volkswagen; Porsche; Toyota |

| Port Everglades | Industrial and heavy equipment | Hurst |

| Miami | Clothing, medical equipment and pharmaceuticals, metal products, and printing | Steiner Atlantic; Noven Pharmaceuticals |

| West Palm Beach | Ships and boats | Rybovich; Horizon Yacht; Bahama Boat Works |

A more detailed connected risks report will be sent to our partners. If you wish to receive the report, please sign up with your name and contact details below.

Hurricane Irma’s Forecast Cone image courtesy of the National Hurricane Center.

About 20 months after the Tianjin Port explosions that left insurance companies with as high as ~$4bn in claims, the port stays abuzz with cargo activities, with Beijing-based companies expected to invest $23 billion in the city. In 2016, the port saw throughput volumes to the tune of 14.49m teu, a 2.9% year-on-year rise.

- “Tianjin port will apply the brakes to coal transportation by trucks from the second half of 2017, to alleviate pollution caused by diesel-powered trucks and coal consumption”, the mayor said.

- Environmental clean-up is complete, new facilities built to improve local surroundings

- The Ministry of Environmental Protection have established an environmental monitoring station to scrutinize the port and surrounding areas 24 hours a day

- For four months after the blast, the city had checked more than 2,000 enterprises that dealt with dangerous substances and chemicals

What are insurance companies doing?

Adopting InsurTech

“Insurance Technology” or the topic of technology-driven innovation in insurance is the focus for most insurance companies. Drones, robots, start-ups in this space, are contributing to its growth. Sensors built on ‘Internet of Things’ are being used on cargo to help companies rapidly understand the situation after catastrophic events (e.g.: the Tianjin explosion)

Applying Changes to Cargo Underwriting

- Building newer disaster models and cargo models

- Improved understanding of risk accumulations

- Pricing for the unknowns

What do experts say?

All Eggs in One Basket

The Tianjin event highlighted how risks can be accumulated in a single location. A massive 285 of the Fortune Global 500 companies had facilities there. Following the event, insurers and reinsurers were exposed to claims from multiple lines of business, involving multiple policies across property, marine, motor vehicle and personal injury.

Data for annual turnover in terminals, average turnaround times and market share of an insurer etc., enables calculation of risk scenarios and to identify accumulations.

Know Thy Neighbor

If the underwriters in case of Tianjin had known about the presence of lethal chemicals in Ruihai International Logistics, they would have priced the risks very differently. It is essential for underwriters to understand and evaluate neighboring risks/risks in proximity.

BI from human error supersedes those from Nat Cats

Mr Damien Pang, Head of Short-Tail Claims at AGCS Asia, notes that increasing BI claims are more from human error or technical failure rather than from Nat CATs. He suggests companies to increase their supply chains’ resilience by mapping them, identifying critical suppliers and their locations, get back-up suppliers and increase stocks. “These “redundancies”, once considered “cost-blocks”, are now instead viewed as investments in reliability and safety” he adds.

Big Data and Analytics

To fully exploit the capabilities of Big Data and Analytics, quality data is needed. Industry experts had commented that effective data communication was lacking throughout the underwriting process for the Tianjin event.

An industry-wide transformation is happening in this area:

- Consultancy firms launching newer and better cargo modelling tools.

- Containers are being fitted with RFIDs to help identify locations.

- Learning lessons from property businesses in Florida where risks come into the market with huge amounts of exposure information.

Big Data and smart analytics will help make marine data more accessible, thereby enabling better assessment of cargo risk accumulations and create greater scope for modelling. They can also be used to build a knowledge profile of an area or specific property, including proximity to Nat CAT risks.

References

Why should I care about InsurTech?

http://www3.asiainsurancereview.com/Magazine/ReadMagazineArticle?aid=37947

https://www.lloydslist.com/ll/sector/insurance/article522140.ece

Container ship by anaulin is licensed under CC BY-SA 2.0

Presenting at an InsurTech Day Event

Around the end of last year, we at Adapt Ready were excited to be selected as one among Top 10 startups for Startupbootcamp InsurTech 2017, a global insurance accelerator working alongside a large portfolio of leading insurance players to foster disruptive and collaborative insurance innovation from early stage startups.

We are half-way through the accelerator, and I wanted to take this time to reflect on how far along we have come in just the last few weeks. It has been educational, exhilarating, exhausting, and yes, even fun – despite 80-hour work weeks.

Educational, because we at Adapt Ready are “new” to the insurance industry in general. Or were, before the start of the program anyway. Not anymore. Thanks to laser-focused training aimed at upstarts, the program prepared us well in our journey to become an InsurTech company – and at the perfect time, too. According to a report from KPMG, 2017 will see InsurTech make its mark.

The program even has an Actuary-in-Residence to understand processes and workflows within the industry, bounce off ideas, and get a deeper look into an established industry. Did you know that property insurance can be traced back to the Great Fire of London, back in 1666?

Exhilarating, when you sit next to people who are eventual users of your product – and they take the time to guide you and help you refine the product based on their needs. This close interaction with our users has helped Adapt Ready immensely in understanding the customer journey and design/build features that users want. And because we are able to iterate designs quickly with our lean approach, we are able to get feedback faster and improve.

It’s one thing to come up with an innovative idea and build a product around it, but there is so much needed around it to make it a viable, successful business – especially in the insurance industry: knowing how to navigate the inherent complexities, understanding the pitfalls and roadblocks, intertwined relationships, all of which are critical to develop partnerships, a product that users will love, and an effective sales/marketing strategy.

The support provided by Startupbootcamp mentors and partners – both in the insurance industry and the periphery – is unparalleled: not only do they give their time but also the resources to help us succeed, and almost on a daily basis.

Exhausting, where over 80-hour work-weeks is the norm. With workshops covering everything from legal and design thinking to PR and branding, and a special emphasis on pitching and crafting the startup story. All of this while we are actively engaging 4 large insurers and in discussion with 6 more — while also fundraising to close our seed round. And if we run into any challenges, the Startupbootcamp team is always so resourceful, whether it is making the right connections or giving us the extra push we need in meeting a deadline, or practice and feedback for pitching our product demo to an investor.

Fun, thanks to the other startups in the cohort and the Startupbootcamp team. We may not have succeeded in “Escaping the Room“, but you can be rest assured we are back in the office bright and early the next morning.

March 8 is International Women’s Day. We pride in being a woman-founded and woman-led startup (and incidentally, the only female CEO in the 2017 InsurTech cohort), and strive to making gender equality a reality.

Being the startup spotlight for the week of February 28, 2017 at StartupBootCamp led to a series of fun and interesting Q&A session with our founders, Shruthi Rao and Sandeep Chandur

Click the below external link to view the article

Feb. 27 2016, marked the release of the 2016 Berkshire Hathaway’s shareholder letter to investors, and the highlight of the 30-page report (taking aside the performance of their funds) seems to be that Warren Buffett dismisses the idea that climate change could be a big financial risk to Berkshire Hathaway’s insurance business.

And you might, rightly, ask: how does this topic come about now? The answer is that for a number of years now, there has been a growing concern amongst Berkshire Hathaway’s shareholders regarding the company’s stand on climate change risks. So much so that a proposal has been filed by the Nebraska Peace Foundation (which owns a single Berkshire share) asking the investment firm to file a formal report on the risks climate change poses to its business.

However Berkshire (one of the world’s largest property insurers and insurers against catastrophic risks) challenges those claims, stating that insurance policies are customarily written for one year and re-priced upwards to reflect growing risks, so climate change could actually increase Berkshire’s profitability.

Here at Adapt Ready we think differently.

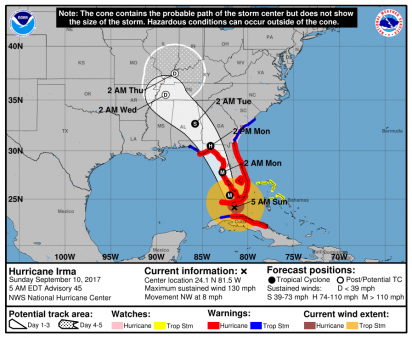

Firstly, one must realize that extreme weather events are happening more frequently than even before (these include long-lasting drought in the state of California, flooding of “biblical” proportions in South California, etc.). Research shows that extreme heat-waves and heavy rain-storms that previously only occurred once every 1,000 days are happening four to five times more often now.

Secondly, every recent year marks a record high of the Earth’s surface temperature. NASA warns that most of the warming occurred in the past 35 years, with 15 of the 16 warmest years on record occurring since 2001.

Last year was the first time the global average temperatures were 1 degree Celsius or more above the 1880-1899 average. This tendency will only increase the likelihood of extreme weather events happening near you.

Lastly, the enterprise community is becoming more and more aware of these risks and is taking steps to become more resilient, overcoming frequent short-termism of business decision-making and embedding sustainable practices by orienting themselves to much longer term goals.

The insurance industry must adapt and work closely with communities and enterprises in order to match the needs of those parties in reducing the effects of climate change.

The moral of the story: Don’t let Berkshire’s insurance conglomerate take a bite of your hard-earned bottom line, invest in proactive protection and save on insurance premiums.

- 1

- 2