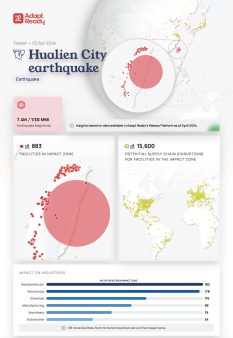

This week came the devastating news that Hualien City, on the east coast of the island of Taiwan, had been hit by a powerful, 7.4 magnitude earthquake. The quake toppled buildings, ripped apart roads and left at least ten dead and nearly one thousand injured (at the time of writing), and it was the largest to hit the island in twenty-five years.

Though a relatively small island by geography, Taiwan is a major hub for the importation and exportation of goods, with trade valued at $901bn in the year 2022. Over 40% of this trade is accounted for by just three countries, China, the United States and Japan.

Some of the world’s largest companies rely on Taiwan for the manufacture and supply of their components and products including Apple, Cisco, Bose, Bosch, Caterpillar, BMW, Airbus, Rolls-Royce and Daimler.

Any major disaster to hit the island will inevitably cause some level of disruption to this busy supply chain. Risk and insurance managers worldwide need to carefully monitor the unfolding situation and consider how damage to the country’s buildings and infrastructure may negatively impact their own businesses, reviewing their business continuity plans to ensure they can mitigate as much of this disruption as possible.

Exposing vulnerabilities

Taiwan is one of the largest producers of semiconductor chips in the world, and though this week’s seismic activity occurred on the Eastern coast of the island, reports suggest that some of the country’s semiconductor giants located on the Western coast were forced to evacuate their staff from machinery plants, temporarily halting production across a number of sites.

In 2023, the top ten countries importing these semiconductor chips from Taiwan (by value) were: China, Malaysia, USA, South Korea, Japan, Vietnam, Thailand, Germany, Mexico and Singapore.

Though we don’t believe that this temporary cessation will have an immediate significant impact on the global production and supply of semiconductor chips, the event exposes the vulnerability of the manufacturing and export of these essential components. With such a large percentage of the world’s manufacture and supply of semiconductors concentrated in a small area, one known to be at high risk of seismic activity, we see a significant vulnerability that could threaten the production of mobile phones, laptops, tablets and other essential communication tools.

Possible disruption to energy supplies

We understand that the Ho-Ping port, serving the Ho-Ping coal plant, located on the East coast of Taiwan suspended operations at the time of the quake, but if the plant itself ceased operations or suffered any physical damage, energy supplies to the North of the county could be impacted.

The Changbin and Datan onshore wind farms are also located close to the epicentre of the quake, if they suffered physical damage to their buildings and equipment or disruption to their operations, energy supplies in the country could be further impacted.

When major disasters occur, we are reminded of just how interconnected our world is, highlighting vulnerabilities we may not even have considered. In the case of Taiwan, the concentration of semiconductor manufacture and supply could prove costly for risk managers in the event of an earthquake, or volcano, not only if buildings themselves are damaged, but if the power plants fuelling them are impacted.

As the situation in Taiwan unfolds, we’ll be keeping an eye on global supply links and will be helping our customers to map the possible fall-out, ensuring they have a clear picture of the risk facing their operations, and identifying viable solutions/alternatives to mitigate their supply chain dependencies/weaknesses.

To better understand how the Adapt Ready platform can be used to quantify risk and plug the data gap in global risk exposure, contact us.