The Mona Lisa will reportedly “stay dry” as historic floods sweep Paris. But the fact that the world-famous Louvre museum has closed its doors to the public and scrambled to protect its vulnerable artwork, shows that no industry or part of society is immune from extreme weather and climate risks.

The Seine river in Paris has risen 16 feet as of June 2 and is expected to peak June 3. At least 10 people have died as thunderstorms and heavy rain swept across western Europe, hitting Germany and France the hardest. Thousands have been evacuated in both countries, streets in Paris have been closed and power shut down in many regions.

While likely not to exceed the Paris flood of 1910, when the Seine rose 26 feet, much more infrastructure, business and settlements are situated in vulnerable areas. The economic costs will be hard to calculate, but will certainly be comparable to the billions in losses incurred by communities in Northern England last year.

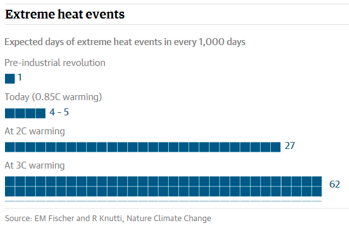

Based on future rainfall projections, a recent study estimated that by 2050, annual average flood losses across Europe will amount to about $26MM a year; up from current averages of $5.5MM.

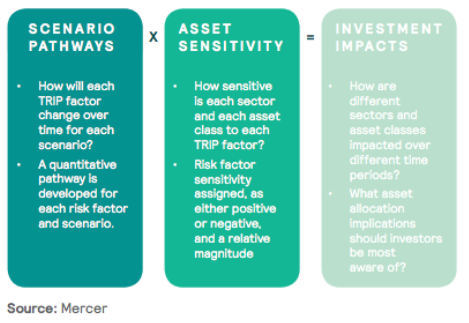

Evidence of climate risks across society and industry, from food and beverage and consumer goods companies to investors and insurers, is mounting every day. It’s time to prepare for change and adapt with intelligence.