As the Coronavirus pandemic continues to spread globally, personal protective equipment and critical care items are in short supply. PPE and healthcare accessories and devices such as ventilators are in great demand to treat patients with COVID-19 and contain the spread of the coronavirus.

COVID-19 has caused severe disruptions to global supply chains, and one of the industries most affected is healthcare. With more than 3.6 million confirmed cases and at least 254,586 deaths worldwide as of May 5 and growing, according to the World Health Organization, the coronavirus pandemic is the most significant public health emergency in many years.

As an early stage startup that has mastered optimizing public and proprietary data to provide risk intelligence, we have traditionally been releasing reports of business impacts/supply chain disruptions during every major event. While analyzing the business impacts of COVID-19 on pharmaceutical industry, we realized the disconnect between the supply and demand of sourcing PPE & CCE around the world.

So, we decided to use the external data capturing capabilities of our platform, powered by Big Data/AI, to address this very pressing need and built an application that lists manufacturers and retailers that provide all the necessary equipment identified by the WHO as necessary for battling COVID-19. The app is free to use for governments, states, cities, hospitals and private distributors, making it extremely easy to locate contact information and reach out to manufacturers/retailers at their fingertips.

With COVID-19 cases still on the rise, particularly in the United States (1.1 million+ cases and over 70,000 deaths as of May 5), PPE, CCE and healthcare accessories and devices are needed more than ever before.

- With little help from the federal government, states are looking to the open market, where they are met with demand pricing and forced to bid against each other.

- The open market can also be murky, subject to scams and counterfeit products. To prevent this from occurring we have ensured that they are trusted and approved by US and EU regulators (all manufacturers are FDA-approved).

- Adapt Ready bridges this disconnect between supply and demand of sourcing PPE/CCE by breaking through the noise of a complicated and difficult market to put consumers and organizations directly in touch with manufacturers and retailers to combat soaring prices and empower state/local governments, NGOs, hospitals and others in the healthcare ecosystem to collaborate and take the buying process into their own hands.

This is an app for social good and free to use. While originally designed for Apple iOS and Google Android platforms, due to the pandemic, they are only launching apps from government organizations, NGOs and healthcare institutions. For now, we have made it publicly available at https://covid19.adaptready.com. We are seeking partnerships with government/NGOs and healthcare organizations to launch the app – and welcome you to reach out for more information. Please share this with your network and help spread the word, so we can collectively have an impact on fighting COVID-19.

About Adapt Ready:

Adapt Ready’s ground-breaking risk intelligence platform delivers new data insights and fills in key gaps with external data, enabling our customers to better manage operational and financial risks, and to enhance their growth and profitability. With our platform, organizations can gain insights from external data tailored to specific situations before, during and after a crisis:

- Before: Plan for risks by uncovering as many hidden risks as possible

- During: Mitigate the impact – as events unfold, new data emerges and can inform decisions to reduce the event’s impact

- After: Adapt to new conditions and refine future business direction

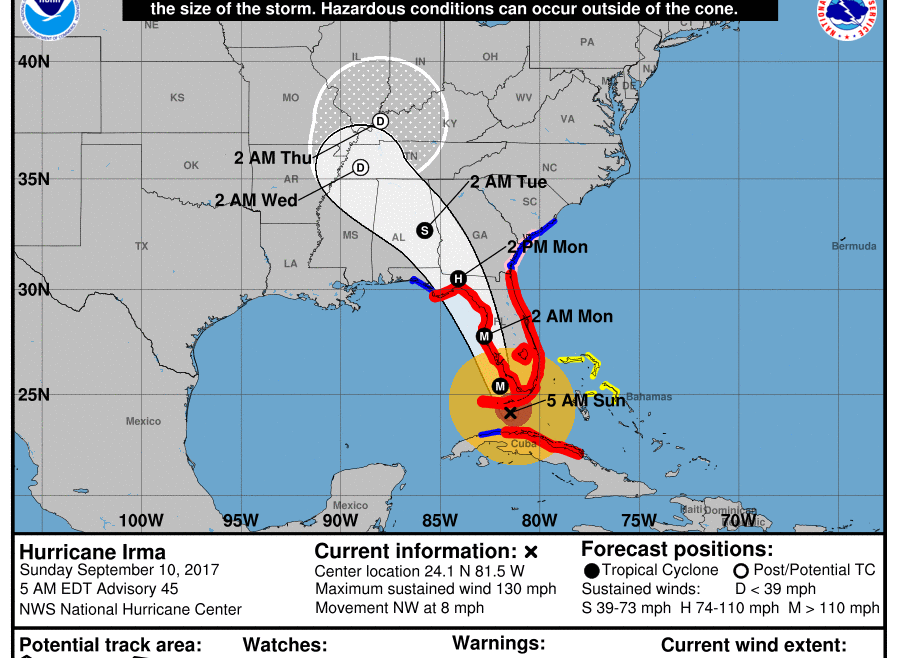

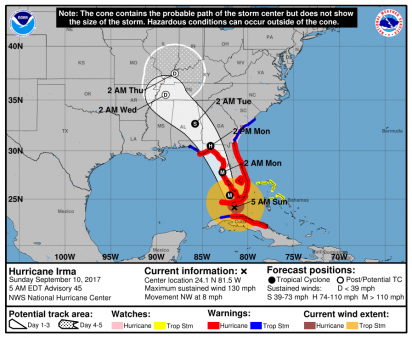

As Hurricane Irma barrels down on Florida, insurers are vulnerable to a myriad of exposures. As of this writing, all the major and minor ports serving the state have been shutdown.

As Hurricane Irma barrels down on Florida, insurers are vulnerable to a myriad of exposures. As of this writing, all the major and minor ports serving the state have been shutdown.