Reports And Information That Matters The Most

Adapt Ready regularly publishes commentaries and analyses on major events, from the business impacts of natural and human-made catastrophes to the COVID-19 pandemic’s effects on global supply chains and actions that businesses can take before, during and after an event

Reports And Information That Matters The Most

Adapt Ready regularly publishes commentaries and analyses on major events, from the business impacts of natural and human-made catastrophes to the COVID-19 pandemic’s effects on global supply chains and actions that businesses can take before, during and after an event

International Financial Stability Board Strengthening Climate Risk Disclosure

The Financial Stability Board will release climate risk recommendations by the end of the year.

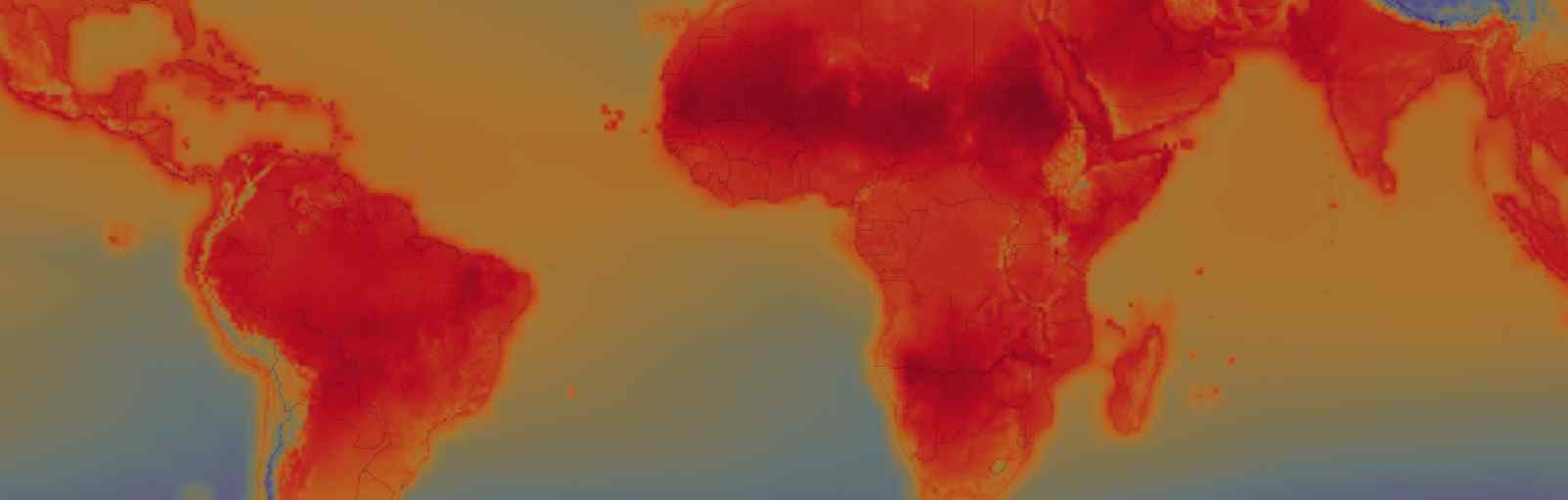

Adapting to Climate Change with Intelligence

In this article for the CEF, CEO Shruthi Rao recollects her visit to the COP 21 at Paris, and her takeaways Click below external link to view the article I returned from COP 21 in…

Don’t Let Mr. Buffet Take Your Hard-Earned Money

The 2016 Berkshire Hathaway’s letter to shareholders claims that climate change will not affect its future profitability.

Investors Ramping Up Research and Interest in Corporate Climate Risks

Investors are progressively becoming concerned about corporate climate risks and will expect companies to understand not only their carbon impact, but how a changing planet will affect business operations.

Recurring Record-Breaking

Climate record-breaking is becoming the new norm.

The frequency of catastrophic events appear to be increasing, with a record number of natural catastrophes last year [2014].

| — | Kurt Karl |

Swiss Re’s Chief Economist, 2015 |