Internal conflict is causing business disruption throughout the coffee industry. In South Sudan, which has recently experienced an uptick in violence, Nestle has suspended coffee imports. And, where supply chains have not been interrupted, security threats greatly increase the cost of doing business—coffee from war-torn Yemen costs $173 a pound.

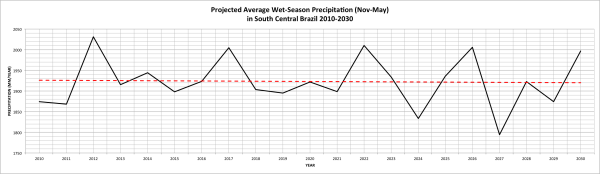

Compounding threats to the coffee supply chain are shifting weather and climate patterns. Up to 50 percent of current coffee growing regions could become unsuitable for this crop this century. Company’s from Starbucks to Peet’s Coffee are already alarmed about this prospect and trying to actively manage this risk.

And, climatic and weather conditions are not just directly impacting coffee growing conditions, but, contributing to conflict in places like South Sudan, where water scarcity has exacerbated existing societal tensions. In a viscous cycle, conflict, insecurity and bad governance, lead to mismanagement of environmental resources.

In this age of ever-emerging risks and heightened global competition, companies must better understand a variety of risks that can have discreet impacts on their business as well as how interconnected threats can compound risk. Leading companies will also be able to proactively anticipate risks instead of responding to them as they happen. Adapt Ready allows organizations across industries to gain this holistic, proactive, view of risk like never before. Get in contact to learn more.