Adapt Ready among the 10 InsurTech companies that gathered to pitch to a roomful of investors, mentors, insurers and technologists during StartupBootCamp’s London Demo day in 2017

Click the below external link to view the article

About 20 months after the Tianjin Port explosions that left insurance companies with as high as ~$4bn in claims, the port stays abuzz with cargo activities, with Beijing-based companies expected to invest $23 billion in the city. In 2016, the port saw throughput volumes to the tune of 14.49m teu, a 2.9% year-on-year rise.

- “Tianjin port will apply the brakes to coal transportation by trucks from the second half of 2017, to alleviate pollution caused by diesel-powered trucks and coal consumption”, the mayor said.

- Environmental clean-up is complete, new facilities built to improve local surroundings

- The Ministry of Environmental Protection have established an environmental monitoring station to scrutinize the port and surrounding areas 24 hours a day

- For four months after the blast, the city had checked more than 2,000 enterprises that dealt with dangerous substances and chemicals

What are insurance companies doing?

Adopting InsurTech

“Insurance Technology” or the topic of technology-driven innovation in insurance is the focus for most insurance companies. Drones, robots, start-ups in this space, are contributing to its growth. Sensors built on ‘Internet of Things’ are being used on cargo to help companies rapidly understand the situation after catastrophic events (e.g.: the Tianjin explosion)

Applying Changes to Cargo Underwriting

- Building newer disaster models and cargo models

- Improved understanding of risk accumulations

- Pricing for the unknowns

What do experts say?

All Eggs in One Basket

The Tianjin event highlighted how risks can be accumulated in a single location. A massive 285 of the Fortune Global 500 companies had facilities there. Following the event, insurers and reinsurers were exposed to claims from multiple lines of business, involving multiple policies across property, marine, motor vehicle and personal injury.

Data for annual turnover in terminals, average turnaround times and market share of an insurer etc., enables calculation of risk scenarios and to identify accumulations.

Know Thy Neighbor

If the underwriters in case of Tianjin had known about the presence of lethal chemicals in Ruihai International Logistics, they would have priced the risks very differently. It is essential for underwriters to understand and evaluate neighboring risks/risks in proximity.

BI from human error supersedes those from Nat Cats

Mr Damien Pang, Head of Short-Tail Claims at AGCS Asia, notes that increasing BI claims are more from human error or technical failure rather than from Nat CATs. He suggests companies to increase their supply chains’ resilience by mapping them, identifying critical suppliers and their locations, get back-up suppliers and increase stocks. “These “redundancies”, once considered “cost-blocks”, are now instead viewed as investments in reliability and safety” he adds.

Big Data and Analytics

To fully exploit the capabilities of Big Data and Analytics, quality data is needed. Industry experts had commented that effective data communication was lacking throughout the underwriting process for the Tianjin event.

An industry-wide transformation is happening in this area:

- Consultancy firms launching newer and better cargo modelling tools.

- Containers are being fitted with RFIDs to help identify locations.

- Learning lessons from property businesses in Florida where risks come into the market with huge amounts of exposure information.

Big Data and smart analytics will help make marine data more accessible, thereby enabling better assessment of cargo risk accumulations and create greater scope for modelling. They can also be used to build a knowledge profile of an area or specific property, including proximity to Nat CAT risks.

References

Why should I care about InsurTech?

http://www3.asiainsurancereview.com/Magazine/ReadMagazineArticle?aid=37947

https://www.lloydslist.com/ll/sector/insurance/article522140.ece

Container ship by anaulin is licensed under CC BY-SA 2.0

Being the startup spotlight for the week of February 28, 2017 at StartupBootCamp led to a series of fun and interesting Q&A session with our founders, Shruthi Rao and Sandeep Chandur

Click the below external link to view the article

Co-founders Sandeep Chandur and Shruthi Rao visited the Lloyd’s of London as part of StartupBootCamp InsurTech startup cohort 2017

In our 2017 cohort, we have 10 startups + 1 startup in residence, and these teams represent 6 countries. Because of our internationally diverse cohort, we figured that a visit to Lloyd’s of London market should be a “must” in our program!

CEO Shruthi Rao is part of a delegation of Northeast clean energy company executives to the United Nations Climate Change Conference (COP21) in Paris. She says “Companies that truly understand their vulnerabilities to climate change will invest in resilient infrastructure, secure water services and sustainable energy systems to protect their assets and communities; these improvements, in turn, result in reduced greenhouse gas emissions and better resource management”

Click the below external link to view the article

PepsiCo’s June 4, 2015 announcement that it will launch a new line of craft sodas, called Stubborn Soda, caught our attention. In response to growing customer demand for more natural refreshments, PepsiCo will sweeten its Stubborn Sodas with sugarcane instead of high-fructose corn syrup.

As PepsiCo and possibly other beverage companies transition to using sugarcane as an alternative to high fructose corn syrup and for bottling production, are they considering how climate variability could affect and potentially disrupt this supply chain input?

The importance of understanding the impacts of climate variability can often get lost during larger discussions of climate change, a continuous and long-term increase or decrease to average weather conditions and/or ranges of weather (e.g. more severe or frequent storms). Climate variability describes the way in which climate fluctuates yearly above or below a long-term average value. However, this variability, which is impacted by long-term climate change, will be a key driver of risks to company assets and supply chains in the 21st Century.

How will future climate variability affect Brazil’s sugarcane and PepsiCo’s supply chain?

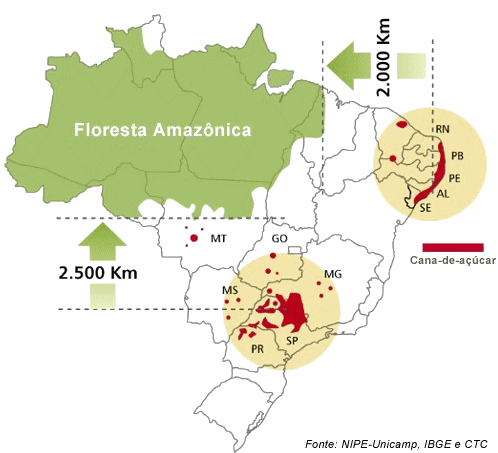

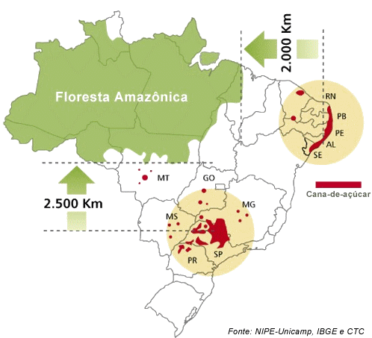

PepsiCo sources a majority of its sugarcane supply from Brazil, followed by Thailand and India. Brazil is the global leader and largest producer of sugarcane, accounting for roughly 60% of global trade and 25% of the world’s supply. Sao Paulo’s region, in particular, boasts approximately two-thirds of Brazil’s sugarcane production with sugar plantations and mills in the northeast supplying the remaining third (Figure 1).

Figure 1: Brazil’s Regions for Sugarcane Production – South Central (Sao Paulo) and Northeast Regions

Successful sugar cane yield, production, and quality are dependent on the right combination of climatic variables. Optimal growing conditions for sugarcane exist primarily in the tropics due to the abundance of direct sunlight, rainfall, and long, warm/temperature seasons, conditions representative of Brazil’s south central and northeast. Yet, as essential as the temperature and sunlight are to the development of sugarcane, adequate and well-distributed rainfall is pivotal for the quality and quantity of sugarcane yields. Furthermore, the sustainability of sugarcane is wholly dependent on how regional climatic variables such as precipitation will vary and/or alter with climate change over time.

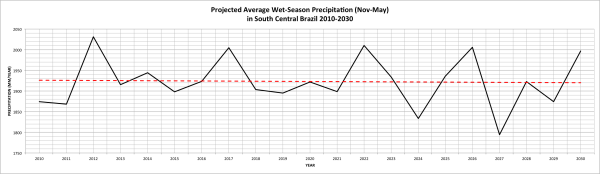

IPCC’s fourth and fifth assessment reports (AR4 and AR5) both project that climate change and variability will disrupt the frequency and intensity of extreme events, heat waves, floods, and droughts. Exemplary of an increase in variability – this February was the wettest month in south central Brazil since 1995 even though the region and the whole of Brazil is still experiencing its worst drought in 80 years. Below normal rainfall has been observed during the November-May wet season for the third consecutive year and directly coincides with the sugarcane planting season in the south central region – Sao Paulo and surrounding areas have experienced 13% and 3% declines (respectively) in sugarcane production for June 2015 when compared to June 2014. Figure 2 shows the high variability in the frequency and intensity of rainfall events averaged November-May precipitation projections for South Central Brazil into 2030. The figure also illustrates the decrease in precipitation from 2012 contributing to the current drought.

PepsiCo and other sugarcane-invested beverage companies will likely take note of UNICA’s recent report estimating a significant drop in sugarcane yields for the 2014/2015 harvests caused by a drought stretching from 2012 in the south central region of Brazil (near Sao-Paulo).

PepsiCo has a history of depending on sugarcane in their operations, not only for sweetening beverages, but also for creating their bottles. Diversification of PepsiCo’s sugarcane acquisition sites or even downscaled sugarcane production in Brazil may be an effective strategy going forward. Otherwise, reactive decision-making could lead to loss of resources, time and revenue

By proactively identifying and responding to climate change risks, companies can more readily adapt to potential climate shock losses and capitalize on climate variability opportunities. Adapt Ready seeks to help global companies do just that by uncovering a variety of physical risks and opportunities, including those associated with climate change, for short, medium and long-term decisions.

* Projected precipitation data obtained from 15 separate Global Circulation Models within the International Research Institute for Climate and Society Data Library (http://iridl.ldeo.columbia.edu/index.html?Set-Language=en). Model data was run under the RCP 4.5 scenario accounting for GHG mitigation into 2100 and within the latitude/longitude constraints/grids of 19.5S-23S, 47W-53W in order to capture the region of south central Brazil. Models include: ACCESS1-0, bcc-csm1-1m, CanESM2, CCSM4, CESM1-CAM5, CNRM-CM5, CSIRO-Mk3-6-0, GFDL-CM3, GISS-E2-R, HADCM3, IPSL-CM5A-LR, MIROC5, MPI-ESM-MR, MRI-CGCM3, and NorESM1-ME.